Highlights of Interim Union Budget 2019-20 (From Exam Point Of View)

The government presents its 10-point agenda that sees India a $5-trillion economy in next five years and $10-trillion 8 years after.

1. Physical & Social Infrastructure: Next generation roads, railways, seaports, airports, urban transport, gas and electric transmission and inland waterways

2. Digital IndiaNSE 0.00 %: Digital infrastructure and digital economy of 2030 to be built on successes of digitisation of government processes and private transactions.

3. Energy security & Pollution control: Through EVs and renewable energy

4. Expanding rural industrialisation: Use modern digital tech to generate employment. Build upon Make in India to develop grass-roots level clusters

5. Clean Rivers: Go beyond the Ganga to include all rivers

7. Space Programme: Global launch-pad of satellites. Place Indian astronaut in space by 2022

8. Food self sufficiency: Making India selfsufficient in food, exporting to the world to meet their needs and producing food in the most organic way

9. A healthy India: Distress-free healthcare, a functional & comprehensive wellness system for all

10. Minimum government, maximum governance: A proactive and responsible bureaucracy which will be viewed as friendly to people

About Interim budget:

shorter than a typical budget cycle, which is normally one year.

• An Interim Budget gives the complete financial statement, very similar to a full Budget.

• Just like the regular budget, estimates are presented for the whole year in the Interim Budget.

Download Full PDF

Economy & Finance

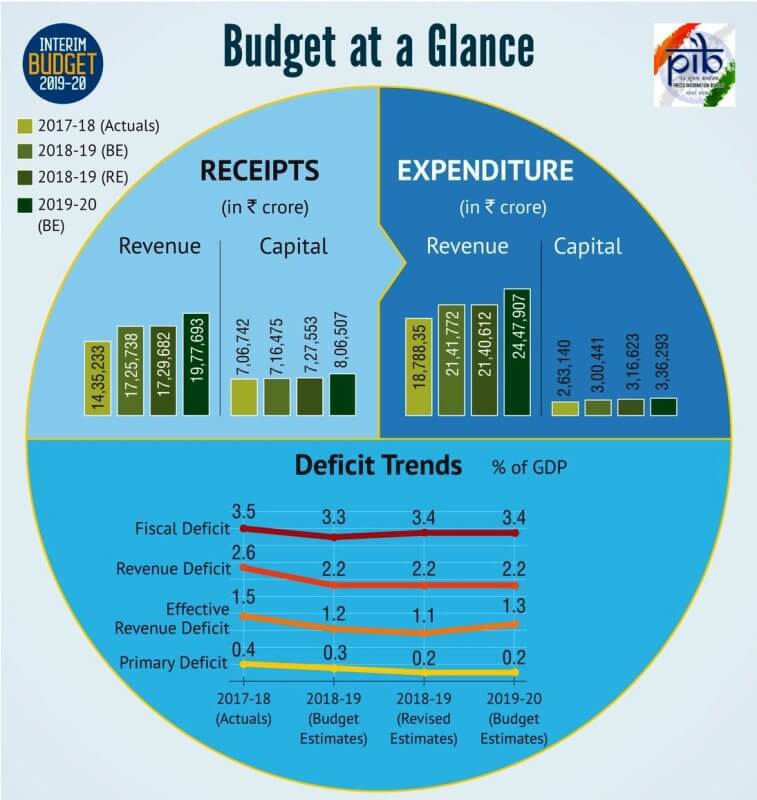

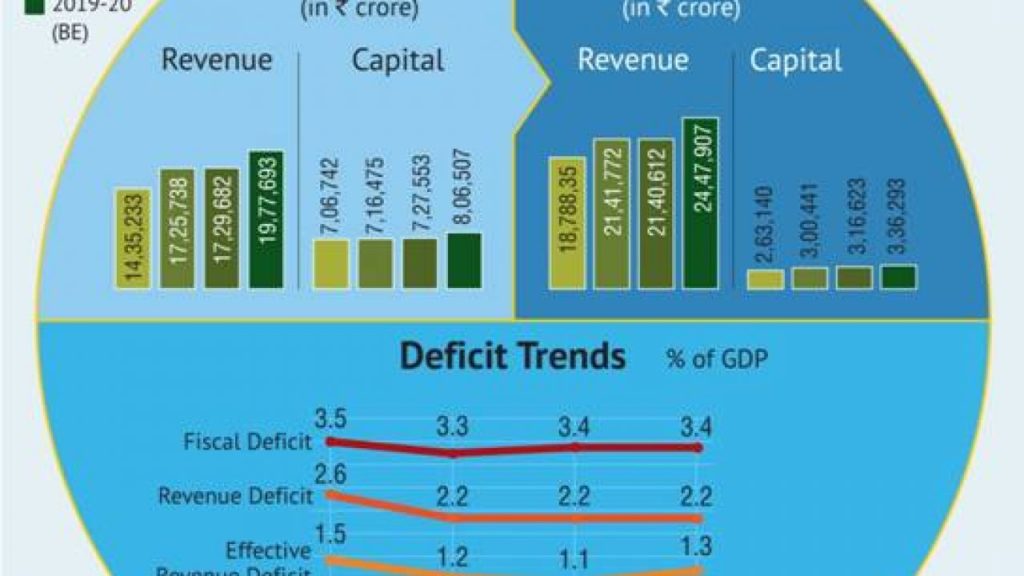

• The fiscal deficit has been brought down to 3.4 per cent as the revised estimates show.

• Capital expenditure is pegged at 3.36,292 lakh crore.

• Expenditure is expected to rise by 13% from revised estimate 2018-19 to budget estimate 2019-20.

2. Current account deficit to be contained to 2.5 per cent

3. In the last five years, nearly 34 crore Jan Dhan bank accounts were opened.

4. India is today the 6th largest economy in the world.

5. Tax Benefits

• Individual taxpayers having taxable annual income up to Rs.5 lakhs will not be required to pay any income tax.

Note:

• The government has proposed a tax rebate on the income up to Rs 5 lakh, meaning that taxpayers earning up to Rs

5 lakh will be exempted from paying taxes but will have to file returns without fail to claim the same.

• The existing income tax rates to continue.

6. For salaried persons – Standard tax deduction for salaried persons raised from Rs 40,000 to Rs 50,000.

7. TDS threshold on interest on bank and post office deposits raised from Rs 10,000 to Rs 40,000

8. TDS threshold on rental income raised from Rs 1.8 lakh to Rs 2.4 lakh.

• The benefit of roll over on capital gains will be increased to investment on two residential houses. This benefit can

be availed only once in a lifetime.

Download Full PDF

Mudra Yojana –

been disbursed through the scheme.

10. In all the total expenditure is to increase from Rs.24,57,235 crore in 2018-19 Revenue Expenditure (RE) to Rs.27,84,200

crore in 2019-20 Budget Expenditure (BE).

11. A rise of Rs.3,26,965 crore or approximately 13.30%. This reflects a high increase considering low inflation

Railways

15. Vande Bharat Express (Train 18) will provide speed, service and safety and will give a boost to Make in India.

16. All unmanned level crossings on broad gauge have been eliminated.

17. The Railways’ overall capital expenditure programme is of Rs. 1,58,658 crore.

18. The Operating Ratio is expected to improve from 98.4% in 2017-18 to 96.2% in 2018-19 (RE) and further to 95% in 2019-20 (BE).

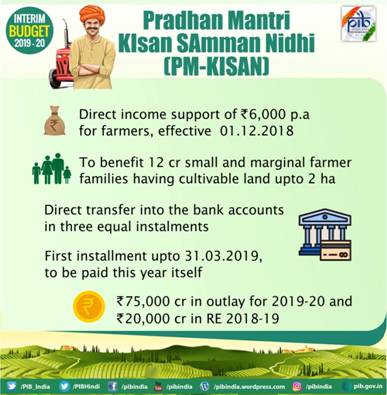

Govt announces Pradhan Mantri Kisan Samman Nidhi scheme for farmers

farmers having less than 2 hectares (5 acre) holdings.

• Budget Outlay – The total outlay will be Rs 75,360 crore.

• Income support – This scheme offers direct income support of Rs 6,000 per year.

23. Pradhan Mantri Gram Sadak Yojana – Rs 19,000 crore allocated for Pradhan Mantri Gram Sadak Yojana.

24. 1.53 crore houses constructed in last five years under Pradhan Mantri Awas Yojana

25. PM Ujjwala Yojana scheme: Six crore free LPG connections distributed so far